Service Animals & ESAs vs. Insurance Companies: What Prevails When the Animal Is a Restricted Breed?

As a property management company, one of the most common questions we get from landlords is:

“If my insurance policy restricts certain dog breeds, can I deny a resident’s

emotional support animal or service dog if it falls under that list?”

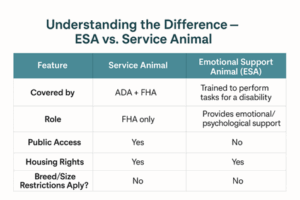

It’s a critical question, and the answer is one that every landlord needs to understand clearly. On one hand, insurance carriers often impose restrictions on certain dog breeds due to liability concerns. On the other hand, federal housing and disability laws require landlords to make accommodations for residents with disabilities, including those with emotional support animals (ESAs) and service animals.

I will break down the legal obligations, explain how insurance limitations interact with federal law, and outline the steps landlords must take to remain compliant while also protecting themselves and their property.

Federal law treats these animals in a very different manner. Service animals have broader protections, including access to public places and stronger legal enforcement. However, both are protected under the Fair Housing Act when it comes to rental housing.

Federal Law Overrides Breed Restrictions

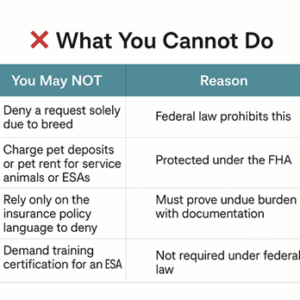

Whether it’s a pit bull, Rottweiler, or German Shepherd, the Fair Housing Act prohibits landlords from applying breed, size, or weight restrictions to service animals or ESAs. The Department of Housing and Urban Development (HUD) and the Department of Justice (DOJ) are very clear:

Landlords must evaluate accommodation requests individually and may not rely on

insurance breed restrictions alone to deny them.

Why Insurers Restrict Certain Breeds

There’s no question that dog-related liability is a real financial concern. Here are key stats from the Insurance Information Institute:

- 22,658 dog bite-related claims were filed with U.S. insurance companies in 2024—a 19% increase from 2023.

- $1.57 billion was paid out in 2024, representing a 41% increase from the previous year.

- The average cost per claim was $69,272, up 18% year over year.

- Over 4.5 million Americans are bitten by dogs annually, with 800,000 requiring medical care.

These rising numbers explain why many insurance policies list “dangerous breeds.” But even with this data, federal housing and disability law still take priority.

What Landlords Must Do When Faced With a Restricted Breed

If a resident’s ESA or service animal is a restricted breed under your current insurance policy, here’s what you’re legally required to do:

- Request written documentation from your insurance carrier showing the policy restriction and any denial of coverage.

- Obtain quotes from other insurers—show that you explored alternative carriers who might insure the property despite the animal.

- Document all communications—including dates, names, quotes, and correspondence.

Unless you can prove that accommodating the animal would cause an undue financial or administrative burden, you must allow the animal, even if it’s a restricted breed.

New Legal Precedent — Chhang v. West Coast USA Properties (Feb 2025)

In a recent federal case, a landlord denied a resident’s request to keep a pit bull as an ESA, citing the advice of their insurance broker. However, the resident sued for housing discrimination under the FHA.

The court ruled:

- Insurance breed restrictions cannot automatically justify denying an ESA.

- The landlord failed to show they had verified the actual policy terms.

- The case was allowed to proceed, reinforcing the resident’s right to be reasonably accommodated.

Key takeaway: Even insurance brokers can be held accountable for misrepresenting policy terms. Landlords must validate everything in writing before taking action.

What About Service Animals and Insurance Conflicts?

If the animal is a service dog, the legal protections are even stronger.

An insurance company generally cannot deny coverage simply because the service

animal is a restricted breed.

Under the Americans with Disabilities Act (ADA) and the FHA, service animals must be accommodated without regard to breed or size restrictions.

As a landlord:

- You must allow the service animal, regardless of insurance policy restrictions.

- If your insurer refuses to cover your property because of the breed, you are still required to:

-

- Get the denial in writing,

- Seek quotes from other providers,

- Document all efforts to secure compliant insurance coverage.

Only if you can show that no reasonable insurance option is available may you potentially deny the request, and even then, this is a high legal bar to meet.

What You Can Do

To stay protected and compliant:

- Require valid documentation for ESAs and a verbal or written explanation of a service animal’s function (only if the disability is not obvious).

- Require renter’s insurance with animal liability coverage.

- Use a written ESA/service animal agreement outlining behavior expectations, cleaning, and care standards.

- Monitor animal behavior and document any issues (e.g., aggression, damage, nuisance).

Your Action Plan

1. Review your current insurance policy’s breed restrictions.

2. Ensure that any denial of coverage is in writing.

3. Proactively identify insurers who accommodate restricted-breed ESAs/service animals.

4. Set up an internal process to evaluate and document ESA and service animal requests.

5. Consult us before taking any action that may result in denial—we’re here to help.

Final Word

Federal law is clear: Disability accommodations take precedence over insurance policy restrictions. As a landlord, the best protection comes from:

- Understanding the law,

- Documenting every step,

- And treating each case individually,

- Use a third-party company, such as Petscreening.com, to verify the legitimacy of an ESA or service animal. There's so much fraud that it’s difficult for the landlord to determine if the documents are authentic.

Don't let misinformation or assumptions expose you to liability. With our team by your side, you’ll stay compliant and confident. Contact us today for expert guidance and peace of mind—because when it comes to fair housing, getting it right matters.